You gained’t be billed an origination fee or prepayment penalty. And establishing autopay will qualify you for an fascination level lower price. But you must currently be described as a Wells Fargo customer to apply for a loan.

If you employ a personal loan, you might get out a few private loans over a time frame. While this might cost you just as A lot, if no more, income in desire and fees, it may well deliver you a far more cost-effective month to month payment. This may very well be an alternative if you are attempting to accomplish a house remodel venture that may be finished in phases.

Secured loans require an asset as collateral although unsecured loans usually do not. Prevalent examples of secured loans contain mortgages and automobile loans, which permit the lender to foreclose on your house from the function of non-payment. In exchange, the rates and conditions are frequently extra competitive than for unsecured loans.

But home equity loans or HELOCs will take as much as per month or even more to disburse funds. (Loans that tap your property equity commonly have lessen rates than unsecured particular loans, so it might be worth the wait around.)

If you do not qualify for an unsecured private loan, you might have other available choices. Should you be a homeowner and possess fairness in the home, you could take into consideration a cash-out refinance or a house equity line of credit rating. In case you have property, you might utilize them as safety for your loan.

Other aspects, for example our personal proprietary Web page policies and regardless of whether an item is offered in your town or at your self-selected credit history rating vary, also can impact how and the place products show up on This great site. Whilst we try to provide a wide array of offers, Bankrate will not include specifics of each and every financial or credit score products or services.

When Do I Repay The Loan? Loan repayment phrases differ by lender. As a result, it is critical to check the loan arrangement out of your lender for info on the lender's repayment phrases. Are There Any Service fees? RiseLoanHub services will always be supplied gratis, but that's not to say the lender offers you a loan without spending a dime. Your lender will demand you expenses and/or desire and have to provide you with total disclosure of their loan conditions on approval. It is actually then your duty to browse throughout the phrases right before signing your loan settlement. Imagine if I would like To Make A Late Payment? Late Payment penalties vary from lender to lender. Lenders might be forgiving for those who contact them specifically, although some may automatically add a cost if it is inside their arrangement. For more info, remember to Make contact with the lender specifically if you have any challenges repaying your loan. APR Information and facts Once-a-year Proportion Rate (APR) actions the price of credit score, expressed for a nominal yearly price. It pertains to the quantity and timing of worth The buyer gets to the amount and timing of payments designed. RiseLoanHub simply cannot warranty any APR considering the fact that we're not a lender ourselves.

The calculator usually takes all of these variables under consideration when identifying the true once-a-year share price, or APR for that loan. Working with this APR for loan comparisons is almost certainly for being additional specific.

Editorial Observe: Intuit Credit score Karma receives compensation from third-celebration advertisers, but that doesn’t impact our editors’ views. Our 3rd-occasion advertisers don’t overview, approve or endorse our editorial information.

It really is always a good idea to check your credit history report as well in the event that There exists misinformation on it. read more If anything is noted in error it could negatively have an impact on your score so it is best to test and get it corrected.

Beneath we spotlight many of the necessities you might require to meet to qualify for big own loans:

Like charge cards or any other loan signed that has a lender, defaulting on personalized loans can hurt someone's credit score. Lenders that look beyond credit score scores do exist; they use other elements which include credit card debt-to-revenue ratios, stable work record, and so forth.

The borrower also should contain the revenue to aid the credit card debt. If a borrower has bad credit score, the speed can be very large-from time to time even exceeding charge card charges. The higher the speed, the upper the payment and the upper the income needed to qualify.

Searching all around for a personal loan can assist make sure you get the ideal deal probable so you devote a lot less on desire and costs, while also finding a loan that works to your distinctive fiscal condition.

Jaleel White Then & Now!

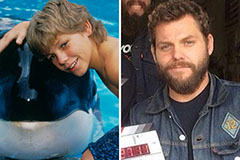

Jaleel White Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!